e-wallets in Belize? – Cash is still King

Results: 1529 Respondents

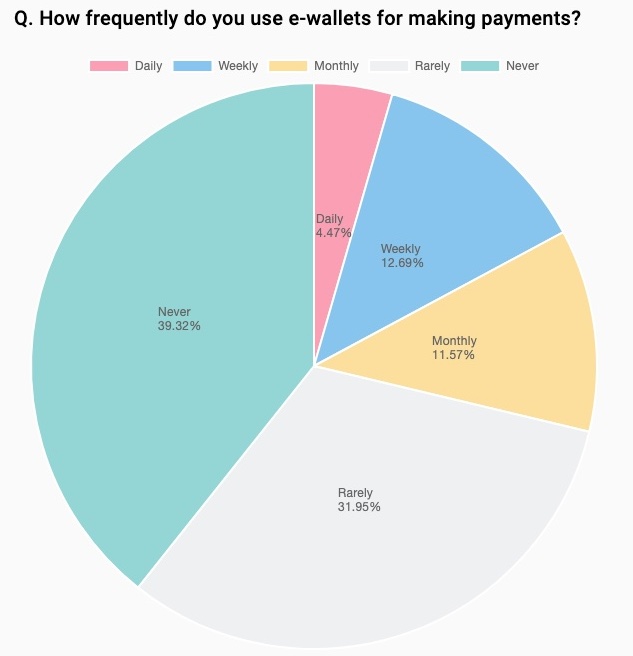

E-wallets are rapidly becoming a popular method for making payments worldwide, and Belize is no exception. We conducted a survey to understand the frequency of e-wallet usage among Belizean residents, gathering insights from 1529 respondents. Here’s what we found:

Key Findings:

Never (39.32%)

- The largest group of respondents, 39.32%, reported that they never use e-wallets for making payments. This significant portion indicates that there is still a considerable segment of the population that has not adopted e-wallet technology.

Rarely (31.95%)

- The second-largest group, 31.95%, indicated that they rarely use e-wallets. This suggests that while they are familiar with the technology, it is not their primary method of making payments.

Weekly (12.69%)

- A smaller, yet notable percentage of respondents, 12.69%, use e-wallets on a weekly basis. This indicates a growing trend towards the regular use of digital payment methods.

Monthly (11.57%)

- 11.57% of respondents use e-wallets monthly, showing a moderate level of adoption where users are comfortable using e-wallets but not as frequently as weekly users.

Daily (4.47%)

- The smallest group, 4.47%, uses e-wallets daily. These are likely early adopters and tech-savvy individuals who prefer the convenience and speed of digital transactions.

Analysis:

The data highlights a varied landscape of e-wallet usage in Belize. A significant portion of the population either never uses or rarely uses e-wallets, which points to potential barriers to adoption such as lack of awareness, trust issues, or insufficient infrastructure. However, the fact that nearly 17% of respondents use e-wallets either weekly or daily is promising. It suggests a growing acceptance and trust in digital payment methods among a segment of the population.

Data Validation – Chon Saan App Orders by Payment Method:

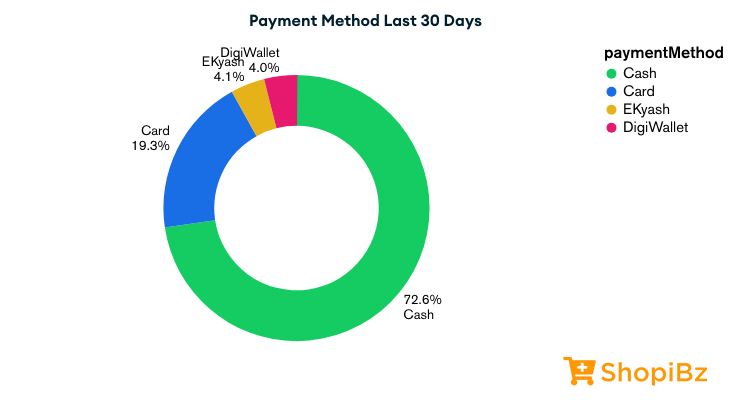

Real-world data obtained from Shopi.bz reveals payment method preferences over the last 30 days, further validating the trends discussed. According to the data:

- Cash remains the dominant payment method, used in 72.6% of transactions. This reinforces the idea that, despite the rise of digital payment options, cash is still king in Belize.

- Card payments account for 19.3% of transactions, indicating a significant portion of the population is comfortable using credit or debit cards online.

- E-wallet usage is relatively low, with Ekyash and DigiWallet representing 4.1% and 4.0% of transactions, respectively. This aligns with our earlier findings that a considerable portion of the population either never uses or rarely uses e-wallets.

These insights from Shopi.bz mirror the trends observed in the Chon Saan Mobile App, where traditional payment methods continue to be preferred over digital ones.

Implications for Businesses and Policy Makers:

- Education and Awareness: There is a need for increased education and awareness campaigns to inform the population about the benefits and security of using e-wallets.

- Infrastructure Development: Enhancing the digital payment infrastructure can facilitate easier access and more reliable service, encouraging higher adoption rates.

- Targeted Marketing: Businesses can target their marketing efforts towards the weekly and daily users, who are already comfortable with e-wallets, while also creating strategies to convert the ‘never’ and ‘rarely’ users.

Conclusion:

While e-wallet usage in Belize is still in its nascent stages, the data shows potential for growth. By addressing the barriers to adoption and enhancing the infrastructure, there is a significant opportunity to increase the usage of e-wallets, making digital payments a norm in the daily lives of Belizeans.

As Belize continues to evolve technologically, understanding and leveraging these insights can help pave the way for a more digitally inclusive future.

View Complete Survey Contents

- How frequently do you use e-wallets for making payments?

- Which e-wallet(s) do you currently use?

- What types of transactions do you primarily use e-wallets for?

- How satisfied are you with the user experience of the e-wallet(s) you use?

- What factors influence your choice of e-wallet?

- How concerned are you about the security of your e-wallet transactions?

- Have you ever experienced any security issues or fraudulent activities with your e-wallet account?

- How likely are you to recommend e-wallets to friends or family?

- How do you typically fund your e-wallet account?

- How satisfied are you with the range of merchants that accept e-wallet payments?

- How important are loyalty/rewards programs offered by e-wallet providers to you?

- How often do you check your e-wallet account balance?

- Have you ever abandoned a purchase because the merchant did not accept e-wallet payments?

- How do you feel about the fees charged by e-wallet providers?

- Do you prefer using e-wallets over traditional payment methods (cash, cards, etc.)?

- How likely are you to switch to a different e-wallet provider if offered better features or benefits?

- Do you feel that e-wallets have made your financial transactions more convenient?

- How important is the speed of transactions when using e-wallets?

- How do you stay updated about new features or promotions offered by e-wallet providers?